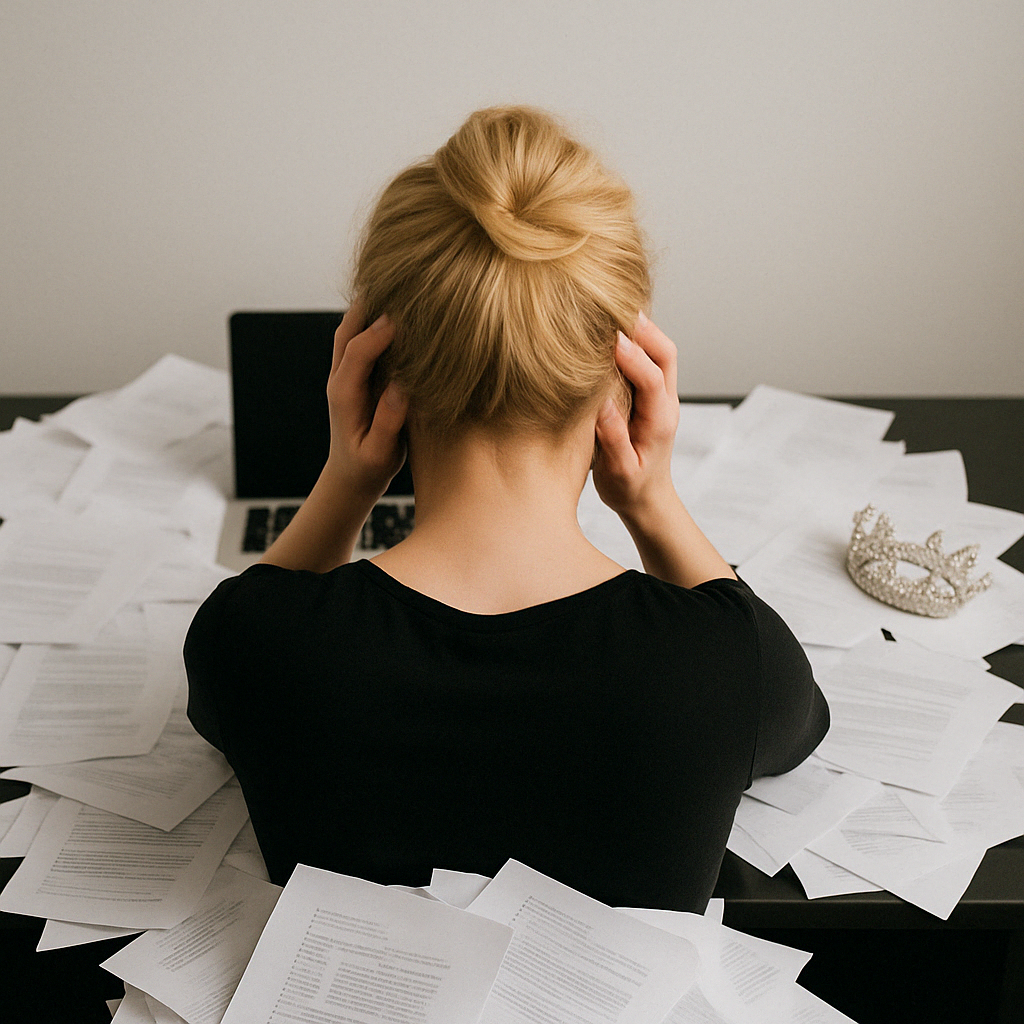

Ah yes, it’s that time of year again—when some brave, chaotic souls sit down to “do their taxes” by opening a dusty laptop, pouring a glass of wine, and attempting to remember what they spent money on 11 months ago.

Cue the game show music:

Welcome to Guess! That! Expense! where every dollar is a mystery and accuracy is optional.

Let’s meet our contestant:

- Owns a fabulous small business.

- Didn’t track anything all year.

- Has a box of crumpled receipts, some bank statements, and a vague sense of panic.

Sound familiar?

Here’s the thing, sugarplum: playing the “Guess My Expenses” game doesn’t make you mysterious—it makes you audit bait. The IRS isn’t interested in your best guess. They want records.

Even worse? You’re probably missing out on legitimate deductions—because if you can’t prove it, you can’t claim it. That’s not just stressful, it’s expensive.

Here’s how to quit the game and take the crown instead:

Track your expenses weekly.

You don’t need to spend hours—10 minutes once a week with your bank feed is royal enough.

Use real bookkeeping software (or at least a spreadsheet).

Whether it’s QuickBooks, Wave, or Google Sheets, use something that organizes your numbers.

Keep those receipts.

Digitally is fine. Just don’t toss them like last season’s trends.

Hire a bookkeeper—or become your own with a little training.

You don’t need to be a CPA. You just need a system. (Psst… that’s where I come in.)

Final word from the Countess:

If your idea of bookkeeping is “guessing and hoping,” we need to have a talk. I love a good game—but not when your money’s on the line.

It’s time to retire from Guess My Expenses and step into your financial power, darling.

Let’s make your books as fabulous as you are.