Greetings, my delightful subjects!

Today, we’re discussing something rather petite, yet exceptionally mighty: Petty Cash. You know, that quaint little stash of money used for small, everyday expenses like office supplies, client coffees, or emergency chocolate bars (royal priorities, of course).

Even if it’s “petty,” ignoring proper tracking can make your bookkeeping anything but regal. Let’s dive into managing petty cash like the bookkeeping monarch you truly are.

What Exactly is Petty Cash?

Petty cash is a small amount of physical money kept on hand for minor expenses. It’s like your bookkeeping duchess—ready to gracefully cover those minor but necessary purchases without the fuss of writing checks or swiping cards every single time.

Step 1: Establish Your Kingdom’s Petty Cash Fund

Choose your petty cash amount—usually somewhere between $50 and $200. Withdraw this amount in cash from your business bank account, and place it securely in a petty cash box (preferably guarded by a dragon… or at least locked in your royal vault).

Step 2: Appoint a Petty Cash Guardian

Assign a trustworthy keeper of the petty cash—a knight of sorts—who will be responsible for distributing cash and collecting receipts. Only this guardian should have access to avoid royal confusion or scandal.

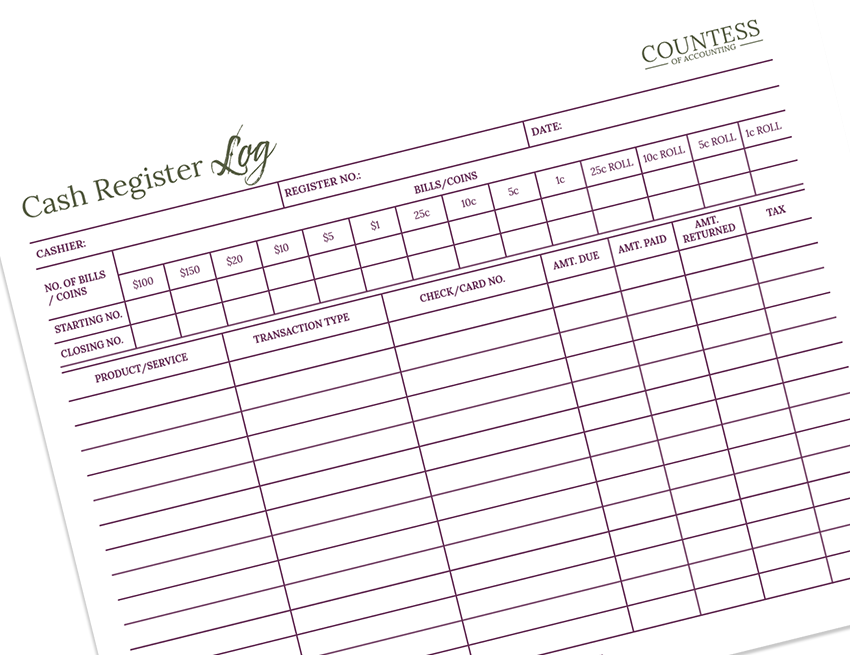

Step 3: Petty Cash Log – The Royal Scroll

Every kingdom requires diligent documentation, and yours is no exception. Use a petty cash log—a simple form where each transaction is carefully recorded. Your log should include:

- Date of Transaction

- Amount Spent

- Description of Expense

- Recipient or Vendor

- Balance Remaining

Think of this log as your treasury scroll, detailing exactly where your precious coins are going.

Step 4: Keeping the Treasure Balanced

Regularly check your petty cash balance against the receipts and log entries. Once the balance runs low, replenish your petty cash to the original amount from your business checking account. Always reconcile the log to ensure your bookkeeping remains royally impeccable.

Royal Troubleshooting Tips

- Lost Receipts: Don’t panic (yet). Fill out a slip detailing the date, amount, and expense explanation. Ensure it’s signed by your cash guardian.

- Overages or Shortages: Small discrepancies happen. Make an adjustment entry in your books, noting the reason. However, frequent mismatches indicate the kingdom’s petty cash policies might need a little refining.

Countess’ Petty Cash Wisdom

Petty cash may be minor in name, but treating it royally prevents headaches during reconciliations and audits. So, embrace these steps and keep your petty cash orderly, accurate, and ever-so-regal.

Remember, meticulous record-keeping isn’t just bookkeeping—it’s royal etiquette.

Yours elegantly,

The Countess of Accounting

Once Upon a Ledger: Emma’s Elegant Events

Emma runs a boutique event-planning company, Emma’s Elegant Events, renowned for throwing the most lavish tea parties. Recently, she established a $150 petty cash fund. One fine morning, Emma’s royal assistant realized they were out of ribbon and lace for an afternoon tea decor emergency (oh, the drama!).

Emma’s appointed Petty Cash Guardian, her trusty assistant Olivia, swiftly retrieved $20 from their locked cash box. Olivia noted the withdrawal on their royal petty cash log with today’s date, the $20 spent, the description (“Ribbons & Lace”), and the vendor’s name (“The Craft Palace”). After the purchase, Olivia carefully attached the receipt to the log.

At the end of the week, Olivia checked the remaining balance in their petty cash box and confirmed all transactions matched the recorded receipts. With the balance now at $130, Emma replenished the fund with $20 from their business bank account, returning their petty cash fund to its original, regal total of $150.

Thus, Emma’s Elegant Events maintained impeccable records, avoided financial fiascos, and continued throwing fabulously royal events without a hitch.